We don’t just build wealth.

We build relationships.

Investors aren't just numbers to us. We value trust, open communication, and shared success.

Michael Guthrie

Michael Guthrie has real-world experience in business, investing, and leadership. A former military man, he moved into the med-tech industry, where he led teams and drove growth before stepping into the ATM business as VP of Sales.

Alongside his wife, Samantha, Michael built Automated ATM Solutions into one of the top five ATM companies in the country before making their 7-figure exit. He focuses on people, relationships, and strategy. Over the years, he has built a strong network and gained deep investing knowledge from both hands-on experience and high-level masterminds.

Michael believes in taking action and making smart moves, not chasing perfection. He’s the kind of person who stands by investors, making sure their interests come first. His approach is simple: find real opportunities, build meaningful connections, and invest with confidence.

"Always pair your goals with action."

Samantha Guthrie

Samantha saw opportunity where others didn’t. When the ATM industry lacked the right tools, she and Michael built their own. With just $2,000, they turned an idea into a business that took them from a 9-to-5 job to full-time entrepreneurship. She created the structure and systems that allowed them to scale, automate, and build real wealth.

Her expertise in real estate and finance complements Michael’s, making Pacific Capital stand out. She brings a depth of wisdom, knowledge, and experience that refines strategies, elevates execution, and drives long-term success.

She brings more than just business structure. She applies life strategies that keep them grounded, focused, and aligned with what truly matters. Her ability to balance precision with purpose is a key part of their success.

"New levels require new thinking."

This is what we stand for.

This is how we do business.

Relationships:

Build connections that create trust and loyalty.

Accountability:

Own our actions, results, and impact.

Integrity:

Choosing what's right over convenience or what's easy.

Transparency:

Be open, honest, and clear.

Our Strategic Advantage

At Pacific Capital, we take a disciplined, data-driven approach to investing and lending. Every investment and loan we make is backed by a tailored business strategy that maximizes returns while mitigating risk.

With decades of experience, strong relationships, and sharp negotiation skills, we get:

Strong collateral and equity protection

Favorable loan-to-value (LTV) ratios and debt coverage requirements

Prime, off market investment opportunities at below-market pricing

Secure better returns for our investors

Our underwriting process includes financial, market, and comparable analysis to assess asset performance, borrower strength, and collateral value. For lending, we ensure conservative loan-to-value (LTV) ratios, strong debt coverage, and clear exit strategies to protect capital. Every deal is backed by a solid business strategy that includes capital improvements, operational efficiencies, and risk management measures.

Most investors rely too heavily on public markets, leaving them exposed to volatility. We help you balance your portfolio with these private assets.

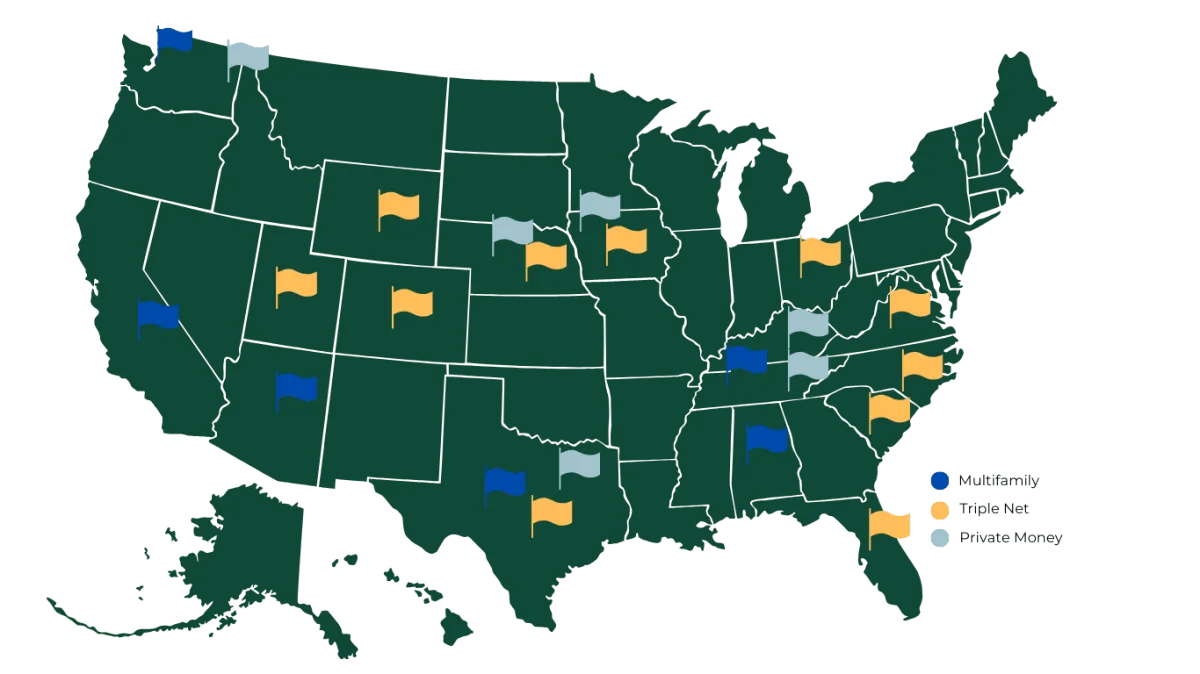

Multifamily

Provides steady cash flow, long-term appreciation, and stability. One of the most reliable wealth-building strategies.

Learn More...

Triple Net

Triple Net (NNN) leasing is one of the most stable, low risk, and passive investment strategies in real estate.

Private Money

Invest in a proven real estate fund and earn passive, consistent returns backed by tangible assets.

Let's create legacies that last! Join our investor community!

Connect with us!

The material contained herein is confidential and includes certain anticipated business operations or investment opportunity expectations of Pacific Capital LLC (the “Company”). However, neither the Company’s management nor its affiliates shall be deemed to have made any express or implied

representations or warranties regarding this material whatsoever, including, without limitation, with regards to accuracy and completeness. In fact, the information, summaries, and forward-looking statements contained herein are subject to material adjustment prior to the availability or acceptance of any investment. Interested persons should make their own investigations, projections, and conclusions without reliance upon the material contained herein with regards to future investments opportunities offered by the Company. This information is not intended to be legal, tax, business, or financial advice.

Please consult with your applicable professional for such advice. The Company, through its management, is still considering an offering of securities exempt from registration under the Securities Act of 1933, but has not determined a specific exemption from registration the issuer intends to rely on for the subsequent offer and sale of the securities. No money or other consideration is being solicited at this time and any information contained herein is subject to modification. Further, if any investment is sent in response to this information, such investments will not be accepted and shall be returned to the funding party.

No offer to buy the securities shall be accepted and no part of the purchase price can be received until the Company determines the exemption under which the offering is intended to be conducted and, where applicable, the filing, disclosure, or qualification requirements of such exemption are met, and anyperson's indication of interest to invest shall impose no obligation or commitment of any kind.

©2023 Pacific Capital LLC. All Rights Reserved.

Privacy Policy | Terms & Conditions.