DATA-DRIVEN STRATEGY

because hope is not a strategy

Our Investments are ideal for

- Aspiring investors who are unsure of where to begin

- Seasoned Investors looking for more diversification or scale their portfolio to the next level

- Individuals or entrepreneurs getting beat down in taxes

- Individuals looking for conservative investments

- Busy individuals who are looking leverage their cash for passive income

- Value-driven individuals wanting to invest in assets that create positive impact

- For those eager to actively manage their financial future and join a community of investors with an abundance mindset

Why Invest?

- Having single income is a blessing, but relying on it alone will give you no room for contingency.

- Millionaires have at least 3-7 additional PASSIVE income streams. They know leverage.

- Do you know someone who retired from their 401K in their 30's or even 40's as multimillionaires? We don't.

- There's risk in everything. Some people don't invest because they're scared of the risks, but by not investing, your money automatically loses its value due to inflation. Give your money a fighting chance.

- Some people say, "I don't have the time". Investing buys you time. Lay the groundwork today, so you can secure more freedom for yourself in the future.

- Oftentimes, it's the most challenging decision that pave the way to the greatest returns. For us, it was the paradigm shift that allowed us to transition from busy entrepreneurs to having the investor mindset in order to get the life we wanted.

- In a time such as this, more good people should have the financial resources to make a difference. The world needs us.

Investing can be a scary place. That's exactly why we're here!

We're here to guide you through the investment process, doing all the legwork of vetting investments so you can invest with confidence and ease.

Our 4D Funnel Framework

Ripe opportunities - not just for us, but for you too!

In building a strong portfolio for generational wealth, you need a solid and tested framework. After all, hope is not a strategy. We employ the 4D Funnel Framework as our cornerstone in selecting prime investment opportunities for ourselves and our investors. Our goal is to present these opportunities in a format that is not only accessible but illuminating for our investors, providing all the essential insights needed for informed decision-making. We pride ourselves on doing the legwork and deep analysis, so our investors can enjoy the confidence and clarity that comes with thoroughly vetted investment choices.

Discovery

Our over 25 years in real estate and business have not only allowed us to develop a network for sourcing top-tier deals but also instilled a disciplined approach to each opportunity. Every deal undergoes a discovery phase, ensuring it meets our stringent criteria for confirming the legality and validity of an opportunity. NO SCAM allowed here!

Dynamic Factors

In our 'Dynamic Factors' review stage, adaptability and insight into market dynamics are crucial. We thoroughly evaluate each investment against shifting economic conditions and market trends, focusing on demand-supply fluctuations, investment timelines, viable exit strategies, and resilience to potential short and long-term impacts of economic factors. This rigorous analysis, grounded in timely data, ensures each decision is strategically sound and resilient. We believe that there is no linear approach to investing. Regardless of your chosen investment instrument, there are variables and dynamics at play.

Diligence

After an investment passes the resilience test in the Dynamic Factors stage, it enters the critical Diligence phase. Here, we delve deep into the investment’s quality, assessing not just the financials but also the more nuanced aspects like the motivations and background of the people involved, particularly the seller. This stage is vital for uncovering underlying factors that aren't apparent in macroeconomic analyses, such as local market trends and property-specific risks. By rigorously examining these elements, our Diligence phase ensures that our investment decisions are thoroughly informed and strategically sound.

Deal Quality

In this stage, negotiation is key. Our team expertly utilizes insights from our comprehensive research to negotiate favorable terms, ensuring each deal aligns with our high standards and investment goals. We focus on more than just price; we negotiate financing terms, contingencies, and timelines, aiming to enhance the deal’s value and mitigate risks. The Deal Quality phase is about securing transactions that promise sustainable, long-term value, turning potential investments into profitable realities for our investors.

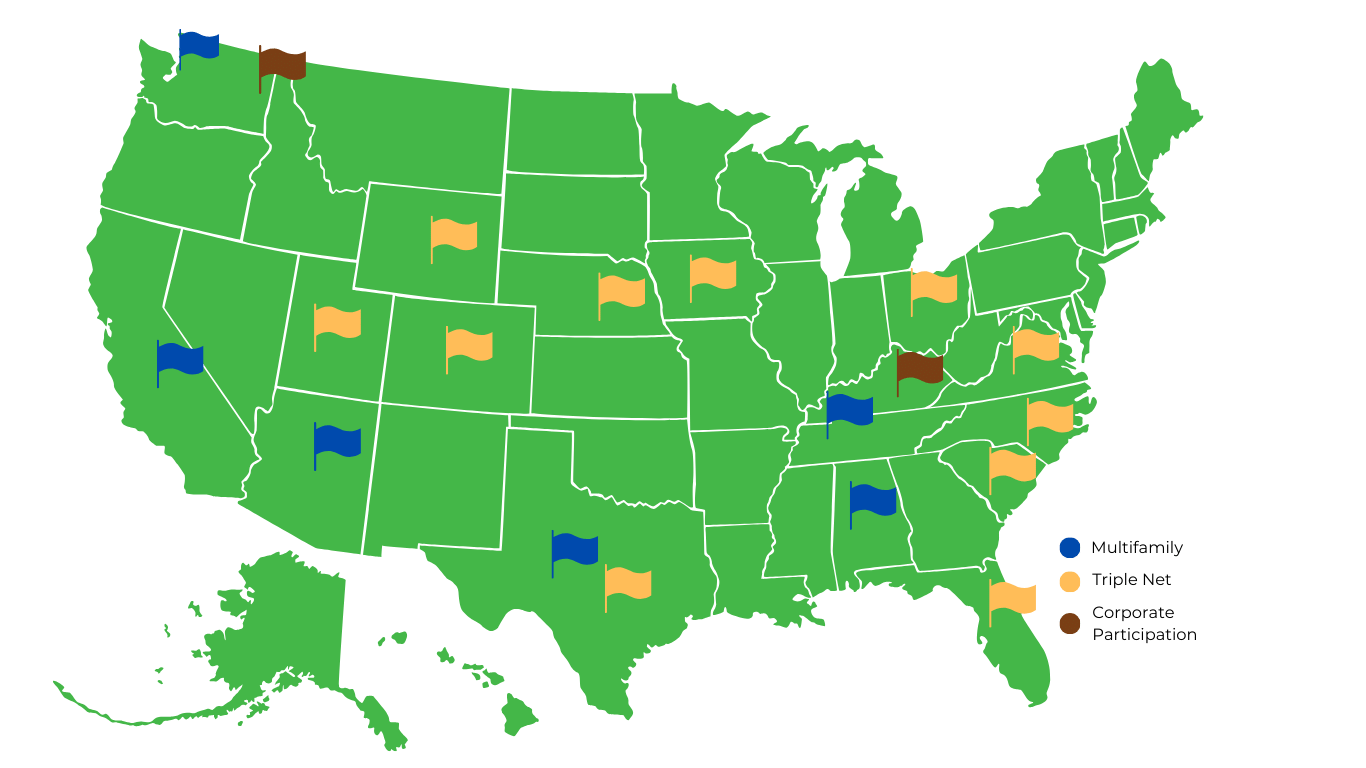

markets we are part of:

Our focus on alternative assets particularly in real estate is driven by their unique return profiles and reduced volatility compared to traditional investment instruments. Real estate investments have stood the test of time as a fundamental wealth-building strategy. Ninety percent of the world’s wealthiest individuals choose real estate as their investment of choice for a simple reason—it’s a necessity, a tangible asset that cannot be manufactured.

Multi Family

Triple Net

Corporate Participation

Other Alternative Assets

Triple Net

Multi Family

Corporate Participation

Other Alternative Assets

How it works

Streamlined: Investing doesn't have to be complicated

1.) We Expertly Source and Vet Deals Using Our 4D Funnel Framework

We actively scout for prime opportunities, leveraging our 4D Funnel Framework that combines our extensive experience with insights from industry experts. This thorough process shapes our investment thesis, ensuring only the best deals reach our table – and yours. If it’s not a standout opportunity, it simply won’t make the cut.

2.) Pooling Resources for Impactful Deals

Together, we unite our financial strengths. You, me, and a network of seasoned investors come together, pooling our resources to make impactful investments a reality.

3.) Guiding Investments Toward Success

Together with a team of seasoned professionals, we closely monitor and adjust our strategies, ensuring that our investments are on a trajectory towards achieving the desired outcomes. Upon stabilization of the investment/asset, investors (you & I) will receive cashflow distributions depending on the investment type. Cashflow distributions are just one of the advantages of the alternative assets we typically invest in such as in Triple Net and Multi Family.

4.) Investment Maturity & Exit

As the investment matures in line with our planned timeline, we will strategically orchestrate an exit. This carefully planned step is designed to allow investors, including you, to realize and benefit from the return on your investment.